Audit Procedures for Cash and Cash Equivalents

Full PDF Package Download Full PDF Package. 625 The primary audit objectives for cash are to obtain reasonable assurance that.

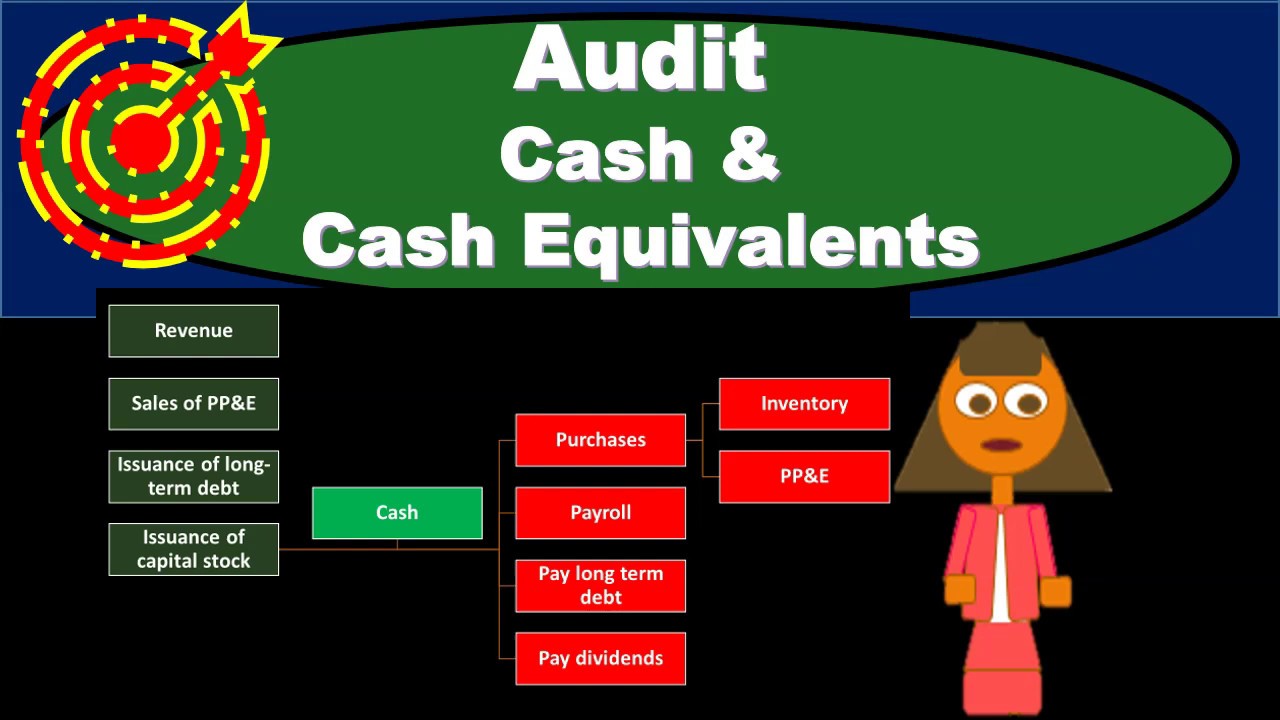

Cash Audit Procedures Assertions Objectives Management Cash Exists Include All Transactions That Should Be Presented Represents Rights Of The Entity Ppt Download

This will help the auditor to plan audit procedures for cash and cash equivalents.

. Petty cash fund including P7500 unreplenished voucher of which P2400 is dated January 3 2007 P 15 b. Cash and cash equivalent are the most liquidated assets on the financial statement. 2 Summarized Business Cycle Cash and Cash equivalent Description 21 You must have obtained the understanding of the entity its business operations so now list down type of cash and cash equivalents.

Some example of. Balances are properly presented in the financial statements. Cash and Cash Equivalent is scoped under IAS 7 Statements of Cash Flows.

Checklist Provide cash and cash equivalents faster than usual. The first is cash which comprises cash on hand and at the bank. Practical Application staff training bundle.

Audit Assertions for Cash. - Examine interbank transfers. The term audit would mean that you need to apply auditing procedures on cash and bank accounts of the company.

In this role as an external auditor of company ABC ie as a member of the external audit team you have to audit bank balances of the company as well as cash in hand. AUDIT OF CASH AND CASH EQUIVALENTS PROBLEM NO. Based on the application of the necessary audit procedures and appreciation of the above data you are to provide the answers to the following.

In addition there is little subjectivity involved and persuasive audit evidence from a third-party is generally available. It is very easy for company to bring any cash on hand and declare it as their cash. - Perform analytic procedures.

The first important task for the auditor is to get a clear understanding of the clients policy and procedure for cash and bank. Understand the client controls you will likely encounter to mitigate those. Implement physical cash limits.

This CPE course can be purchased individually or as part of the Audit Staff Essentials - New Staff. CHAPTER 3 - Audit of Cash Cash Equivalents Problem 1 The CASH account of Don Corporations ledger on December 31 2006 showed the following. The objective of this template is to ensure the Completeness Accuracy Existence and Valuation of cash and cash equivalents.

Redemption Fund Account PNB 500 c. Prepare accurate cash budgets. This video lecture discusses the audit of cash and cash equivalents particularly the substantive procedures to be performed on the said line item.

Account for all cash. AUDITING CASH CASH EQUIVALENTS. Cash balances on the balance sheet really exist at the reporting date.

Textbook Solutions Expert Tutors Earn. Calculate cash requests by considering the programme implementation needs operating costs and replenishment of cash. Based on the application of the necessary audit procedures and appreciation of the above data you are to provide the answers.

Retain documentation for all items of expenditure. Recorded balances exist and are owned by the institution. Cash recorded on the books exist - Count cash on hand- Confirm bank balances.

Cash and cash equivalents tend to be one of the first areas assigned to new auditors since it tends to be straightforward with less complexity and risk as other areas. Travelers check 100 d. A short summary of this paper.

They will need to get idea about the number of banks types of bank accounts. The following are the substantive audit procedures for cash. All of the entitys cash is included - Perform cash cutoff test.

Auditing Cash and Cash Equivalents. In connection with your audit of Caloocan Corporation for the year ended December 31 2006 you gathered the following. The second is Cash Equivalents which are investments that are short-term highly liquid and are readily convertible to.

Gain an understanding of the risks typically present in major balance sheet accounts starting with cash. 5 The high value and liquid nature of many financial investments make the separation of the authorization custody and record-keeping functions especially important. Auditor has to check if the cash on hand balance is reasonable for the size and nature of the business.

Recorded balances are complete and stated at realizable amounts. The company has title to the cash accounts as of the reporting date. Disbursements in July per bank statement P218373 Cash receipts in July per Mathildas books 236452 Questions.

Adhere to general principles for cash control. Interestingly enough this is an area that. It is considered high risk for both company and auditors.

Cash balances include all cash transactions that have occurred during the accounting period. 2 Full PDFs related to this paper. Obtain the bank reconciliation statements for all the bank accounts and test the reconciling items.

AUDIT PROCEDURES FOR CASH CASH EQUIVALENTS MODULE CONTENTSOBJECTIVES. Key Audit Procedures for Cash and Bank Audit. AUDIT OF CASH AND CASH EQUIVALENTS SUBSTANTIVE AUDIT PROCEDURES FOR CASH Cash Balances Existence.

Reconciling items consists of additive. A primary substantive procedure for cash is confirmation of the balances of the companys accounts with financial institutions. In Cash and Cash Equivalents there are two separate components.

Collection by bank of companys notes receivable 71815 80900 The bank statements and the companys cash records show these totals. In the audit of cash we usually test the audit assertions included in the table below.

Cash Audit Procedures Assertions Objectives Management Cash Exists Include All Transactions That Should Be Presented Represents Rights Of The Entity Ppt Download

Audit Procedures For Cash Carunway

Audit Of Cash And Bank Balances

Audit Of Cash And Bank Balances

Comments

Post a Comment